The balance sheet reports a business’ assets, liabilities, and shareholder’s equity at a given point in time. In simple words, it tells you what your business owns, owes, and the amount invested by shareholders. However, the balance sheet is only a snapshot of a business’ financial position for a particular date. In cash-based, you recognize revenue when you receive cash into your business. In other words, any time cash enters or exits your accounts, they are recognized in the books. This means that purchases or sales made on credit will not go into your books until the cash exchanges.

- No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation.

- Bookkeeping is the process of recording your company’s financial transactions into organized accounts on a daily basis.

- You can withdraw a regular salary from the business or, if you’re a sole proprietor, pay yourself using the draw method.

- When your business income mixes with your personal accounts, it doesn’t make more money—it just makes a mess.

With each pay run, make sure you set aside savings to cover the payroll tax from the employee’s pay. Below is a list of the most common tasks that are a part of the bookkeeping process. Of course, this does not apply if the business is operating on a cash basis without extending credit to the customers because the cash will be coming in at the time of sale. You can avoid this scenario by being pro-active about keeping your bookkeeping system up to date and producing reports at least once a month. There are some free bookkeeping software programs available if you are on a tight budget. I give a break-down here of the ones that are of excellent quality and are kept up-to-date.

Can You Start Your Own Bookkeeping Business?

Bookkeeping is the process of tracking and recording a business’s financial transactions. These business activities are recorded based on the company’s accounting principles and supporting documentation. Liabilities are assumed name certificate what the company owes like what they owe to their suppliers, bank and business loans, mortgages, and any other debt on the books. The liability accounts on a balance sheet include both current and long-term liabilities.

As you establish the financial side of your business, here are five best practices to keep in mind when creating a functional bookkeeping system. With this type of service, you can communicate completely by email or phone without having to set aside time to meet in person. The responsibilities handled by a service will depend on the provider, so be sure to discuss the scope of work and compare options to find the right fit.

This way, your cash-tracking document or app is always readily accessible. You can use your streamlined online system to note how much cash is exchanged and why. When you make a cash payment, ask for a receipt to support your recordkeeping when you update the transactions later.

Bookkeeping Hacks to Save Time in 2022

FreshBooks is one of the most highly rated and straightforward programs for accurate accounting records, professional bookkeeper services, and more. Keeping track of bookkeeping tasks as a small business owner can be challenging. You have to know the ins and outs of your business expenses and all your personal and business finances.

You may need to first complete a training program before you can launch. The exact requirements for starting a small business will depend on the state in which you live. You may need to contact your secretary of state or department of revenue for more information on what paperwork you may need to complete to legally establish your bookkeeping business.

When is it time to hire someone?

Regardless of your small business’s complexity, bookkeeping will still take time out of your week, so be sure you have the resources before committing to handling it yourself. Some accounting software products automate bookkeeping tasks, like transaction categorization, but it’s still important to understand what’s happening behind the scenes. It all begins with getting your accounting software set up correctly. Once your bank accounts have been reconciled and any adjustments made in your recording tool of choice, you’ll want to close the month and print financial statements.

- On the other hand, your bank may provide perks for keeping your personal and business accounts with them.

- To ensure that peaceful slumber, form a habit of documenting everything.

- If you don’t feel comfortable with a freelancer, there are many firms that offer bookkeeping services as well.

- Once your business gets under way, you can make a monthly budget to track your cash inflows and outflows.

If your small business uses accounting software, it will help track when invoices are due. Most software programs provide options for automatic bill-paying and bank transfers. Reconciling the books is another challenge for small business owners. Miscalculations can result in large penalties if miscalculations are sent to the IRS or state tax department.

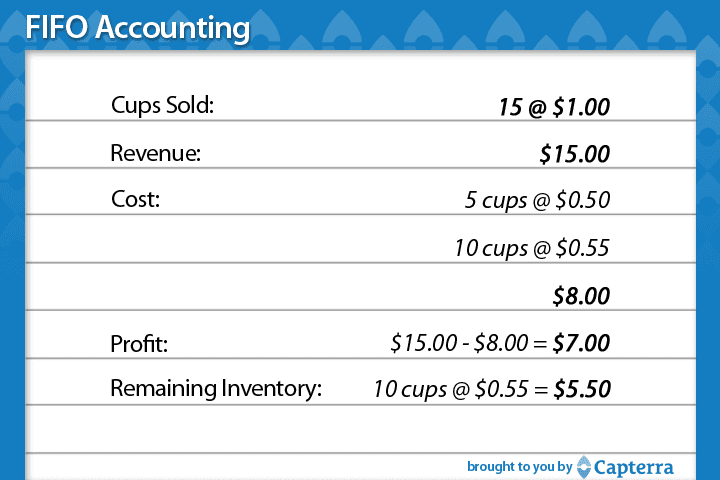

Methods of bookkeeping

The income statement, also called the profit and loss statement, focuses on the revenue gained and expenses incurred by a business over time. The upper half lists operating income while the lower half lists expenditures. The statement tracks these over a period, such as the last quarter of the fiscal year. It shows how the net revenue of your business is converted into net earnings which result in either profit or loss.

So many changes to the tax code were made for 2018 that you should consult your accountant for guidance on what kinds of expenses you can deduct next year. For anything you think you’ll be claiming, maintain detailed records; save time by scanning and digitizing receipts. You can also simplify expense tracking by always using a business credit card for business purchases. To track your business’s financial health, having a bookkeeping system can help you stay organized and aware of where you stand each week and month. A schedule can include paying vendors at a specified time each month, reconciling monthly bank statements, recording revenue weekly, and making regularly scheduled bank deposits.

It allows you (and investors) to understand how well your company handles debt and expenses. By summarizing this data, you can see if you are making enough cash to run a sustainable, profitable business. You might also consider applying for a business credit card to help cover expenses until you start making money. You can apply for a business credit card using your personal credit score and income; business credit is not a requirement.

To streamline your accounting responsibilities, consider automating your accounting process with accounting software. With software, you can say goodbye to spreadsheets and manually crunching numbers. It’s no secret that automation can be a lifesaver for small business owners.