Once the balances are equal, you will then need to prepare journal entries for the adjustments to the balance per book. With the help of Quickbooks, reconciliation is no longer a time-consuming task.

I appreciate the detailed information and screenshot you have provided, joefake1. There are several possible reasons why your bank balance does not match. However, to ensure that your accounts are accurate and to prevent tampering with the data, I strongly advise getting help from your accountant. They’ll be able to offer more knowledgeable solutions for handling this circumstance.

How Often Should You Reconcile Your Bank Account?

If the parent’s balance offset the balance of the sub-accounts, then the parent will zero out while there’s a balance on the sub-account. I’ll share some information with you about your reconciliation. You’ll want to reconcile your parent with the sub-account since all the balances are showing for each sub-account.

QuickBooks, a popular accounting software, provides a convenient way to reconcile your credit card transactions and ensure the accuracy of your financial records. When matching transactions, it’s important to compare each entry on your bank statement with the corresponding records in QuickBooks Online, paying close attention to dates and transaction details. If a transaction matches, mark it as reconciled by placing a checkmark next to its amount in QuickBooks Online. Transactions added or matched from online banking are usually pre-selected for convenience. If a transaction appears in QuickBooks Online but not on your statement, do not mark it. For any discrepancies, like a slight mismatch in payee details, simply edit the transaction in QuickBooks Online to align it with your bank statement.

Step 5 (Optional): Make a Payment on the Credit Card Balance

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Finally, you need to consider if you’re going to be taking out any big loans anytime soon. If you’re going to be getting a mortgage or car loan, for example, you’ll probably want to hold off on opening a new credit card. Find out how to create an invoice in QuickBooks and how to write off bad debt in QuickBooks with our comprehensive guides. In cases involving significant or complex issues, it is recommended to seek the assistance of an accounting professional.

- When you finish a reconciliation, the cleared transactions become reconciled.

- To resolve these issues, add any transactions that are missing in QuickBooks, delete or merge any duplicate entries, and correct the amounts for transactions that have been inaccurately recorded.

- Credit card reconciliation is the system that accountants would use to make sure all the transactions in a credit card statement will match those on the book of the company.

You’re in the right place to learn about the current QuickBooks reconciliation. After you reconcile, you can select Display to view the Reconciliation report or Print to print it. If your beginning balance doesn’t match your statement, don’t worry. Before you start with reconciliation, make sure to back up your company file. However, if you see existing transactions recorded in QuickBooks manually that are identical to the downloaded ones, link them together to avoid getting duplicates. After entering all information, click the Continue button at the bottom of the screen.

Step 2: Entering the Statement Ending Date

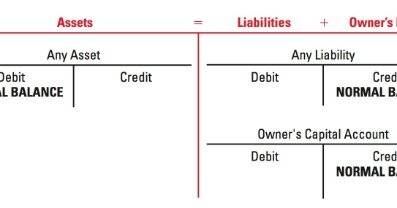

In the bank books, the deposits are recorded on ‘credit’ while withdrawals are recorded on ‘debit.’ The bank will then send the account statement to its customers every month or at regular intervals. Below is an example of reconciliation with all the transactions matched to the statement. To match transactions between QuickBooks and your statement, you have to trace transactions from QuickBooks to your statement as well as investigate unmarked ones.

- Now, simply compare the transactions on your statement with what’s in QuickBooks.

- You should enter a bill because doing so moves a portion of your credit card liability to a current accounts payable (A/P).

- The goal is to have a zero difference between your statement and QuickBooks Online by the end of the process, at which point you can select Finish now.

- That should zero out each sub-account as well as the account with the negative balance.

- It needs to match the balance of your real-life bank account for the day you decided to start tracking transactions in QuickBooks.

Regularly reconciling your credit card accounts will also help you identify any potential issues with your finances, enabling you to take the necessary steps to address them swiftly. Reviewing the transactions is an important step to ensure that your financial records are accurate and match your credit card statement. It allows you to identify how to get funding for a startup a beginners guide any discrepancies or errors that need to be addressed before proceeding with the reconciliation. To run a reconciliation report, navigate to Settings, choose Reconcile, and then select History by account. Reconciliation is an accounting process used to ensure that two sets of records (usually the balances of two accounts) are in agreement.

Step 1: Navigate to the ‘Reconcile’ Window

This allows you to streamline your accounts receivable processing by immediately matching invoices with payments without signing into a contract or paying monthly fees. Aside from that, it also gives you choices on payment for transactions. The endlessly growing sub account balances on the credit card sub accounts, with the zero balance to the main account (or payments applying to the main account only). When you select a transaction’s checkbox, you mark it as cleared (tentatively reconciled). When you finish a reconciliation, the cleared transactions become reconciled. In registers, cleared transaction have a C in the reconciliation status column and reconciled transactions have an R.